- The Options Coach

- Posts

- Pre Market NOV 12, 2025

Pre Market NOV 12, 2025

Pre Market

Good morning traders, how are you today?

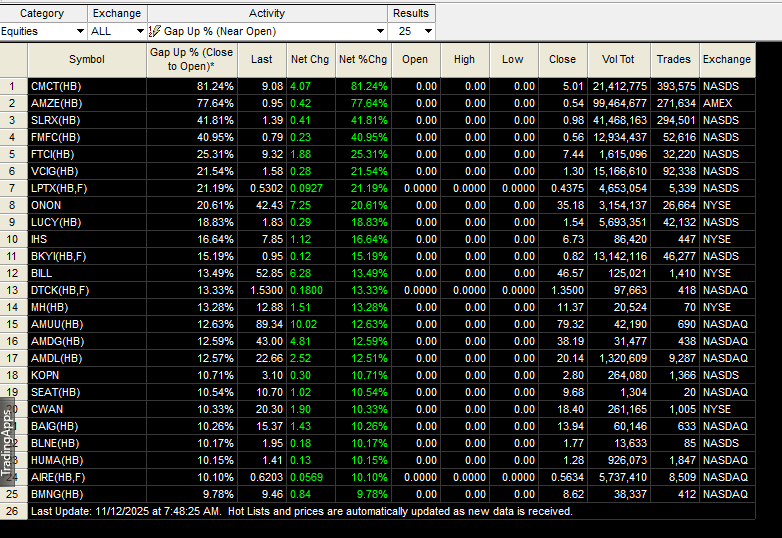

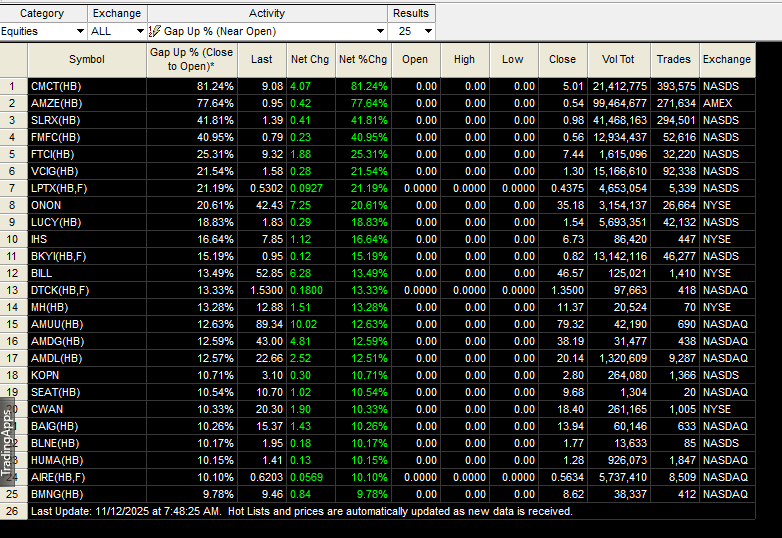

The markets are green here in the Pre

Tech is up on remarks from the CEO of $AMD ( ▼ 1.58% )

$DJI ( ▲ 0.47% )

$SPY ( ▲ 0.72% )

$QQQ ( ▲ 0.89% )

$IWM ( ▲ 0.0% )

Last night I had dinner with a buddy of mine, we were talking about mistakes humans make

Just a few years ago I was a “fly on the wall” and was privy to a business discussion

There was a very well known / loved restaurant / that was a Kansas City landmark that closed

It wasn’t from covid, the restaurant was generational, and all of them enjoyed gambling

They spent / lost, all of their wealth

Back to last night, my buddies - buddy sold his company 10 years ago

He made 16 Million profit on it. His goal wasn’t to retire, but to get on t.v. as one of those online poker stars. He studied the game, played in tournaments, turned that 16M into 25M

Wowww, that’s good….. But now it’s gone, all of it…

Do you think that’s just poker players? Or do you think that can happen in the stock market too?

A month ago I talked about this, please allow me to share it again::::::::::::::::::

Pre Covid buying Calls or Puts ~only~ was considered for starting / new traders

You learned Trade Management in the way of doing multi legged spreads and then advanced

You won’t get rich quick doing Bull Call Spreads, but you won’t blow up your acct either

What did “Uncle Warren” tell us?

Rule #1 Don’t lose money

Rule #2 Go see Rule #1

If the market or a stock is skyrocketing north then of course it can be advantageous to take on more risk and place some trades Naked or Blind

But all of them, all of them? Seriously? That’s how accts get blown up, maybe not every acct, not saying that, but many of them

The stock market is the biggest casino in the world, but we aren’t trying to give them all of our money 🙃

Our old friend $NVDA ( ▲ 1.02% ) is rising, right now price is 196.06

Here at theoptionscoach.net

We don’t chase stocks

We don’t go long if a stock is red

We buy at the MID price or better

We set STOPS and HONOR them

Bull Call Spreads for NOV 21, 2025

Buy the 195 Call

Sell the 200 Call

The MID is 2.10

That one is set up to be a get it, get it done and get out

Want a little more upside potential?

Ratio Spreads

Buy 3 NOV 21 2025 Calls

Sell 2 NOV 21 2025 Calls

The MID is 11.45

Ratio spreads are more advanced

3 to 2 like we are doing here are reduced risk

If a trader wanted more risk / reward then adjust from the 3 by 2 / they would do the 2 by 1

THIS IS IMPORTANT One of the advantage of using spreads is that if our stock slips as long as it doesn’t fall below the amount we have in debit we can still profit

If all we do is buy Blind calls, and the stock slips, then we have to wait for the stock to rise again…… tick toc … tick toc… tick toc……. 😂

It’s time to grind

The Options Coach

DISCLAIMER: All content provided in this newsletter, blog, webinar, video, chart, communication is for Educational and Entertainment purposes only. Nothing included or mentioned is meant to be construed or used as trading / investment / financial advice. Trading / investing carries risk of loss, losses can and do occur. NO recording aloud...Know your risk and risk of loss before taking on any financial endeavors. Past performance is NOT a |

guarantee of future success. I am NOT a licensed or registered financial advisor or tax accountant. Prior to making any trading / investing / financial decisions you should always consult with your licensed and registered financial advisor and tax accountant. There are no recommendations or solicitations to buy, sell or hold any stock, future, options or bonds, cryptocurrency or any other financial entity in this newsletter. Nor are there any recommendations on any type or way or method to trade / invest. You do not have permission to redistribute this newsletter without my written permission fir |