- The Options Coach

- Posts

- Weekly Recap DEC 28, 2025

Weekly Recap DEC 28, 2025

End of year review

Hello traders? How are you?

How was everyone’s Christmas / holiday break?

Did you eat bunches and bunches of great yumm yummzzzzz????

Are your stretchy pants getting a little tight?

If so your not alone, but the good news is that can be easily reversed

I live in America, most of you reading this do too, some don’t

We Americans are near the top for Non Alcoholic Fatty Liver Disease…..

Sounds sexy doesn’t it?

African nations have the lowest

The challenge for the human body is this::::::

Every single stomach / gut issue known to science BEGINS in the liver

Non Alcoholic Fatty Liver Disease is more dangerous than we give recognition too

It can sneak up slowly, causes inflammation, severe bruising, fatigue, is linked to diabetes, kidney issues and even some types of cancers

Yet it is 100% totally, completely reversible by diet and exercise

And drinking home made “flushes” made from raw fruits, vegetables and herbs helps speed up recovery dramaticallyyyy, as in quickly and effectively

It’s one of ( if not the #1 ) simplest and easiest diseases in the world to reverse on our own if we take control of it. Getting it can happen, keeping it is a choice

The markets are no different

2025 saw some wild swings. And many traders were then turned into “investors”

What I plan on doing in 2026 is “flushing” the fat from our Model Portfolio anytime that we get it. And more importantly, not allowing it to get here in the first place

I feel that we did a good job of that this year, but next year I want to do better

My written trade plan for 2026 is now done, and I like the way its written out

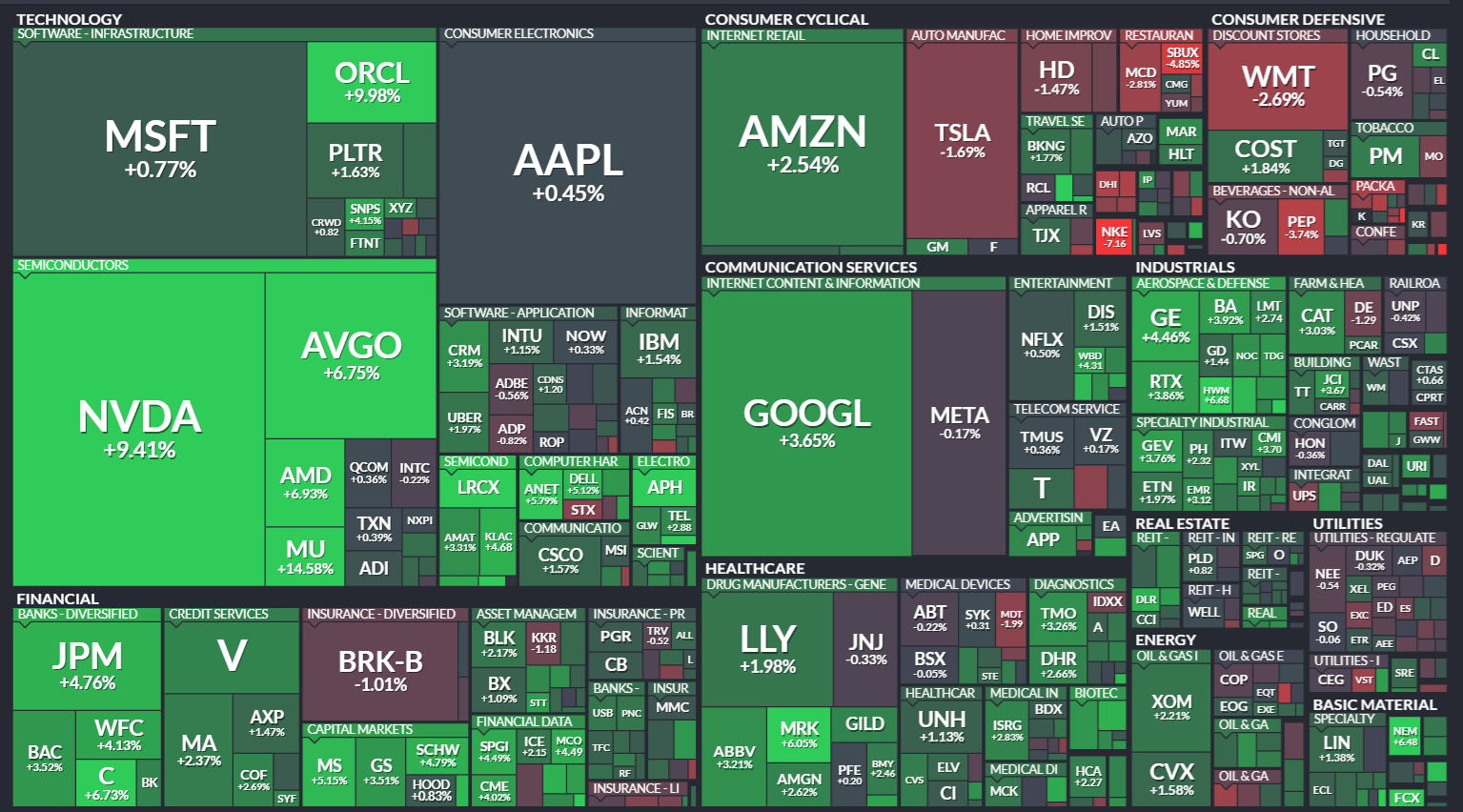

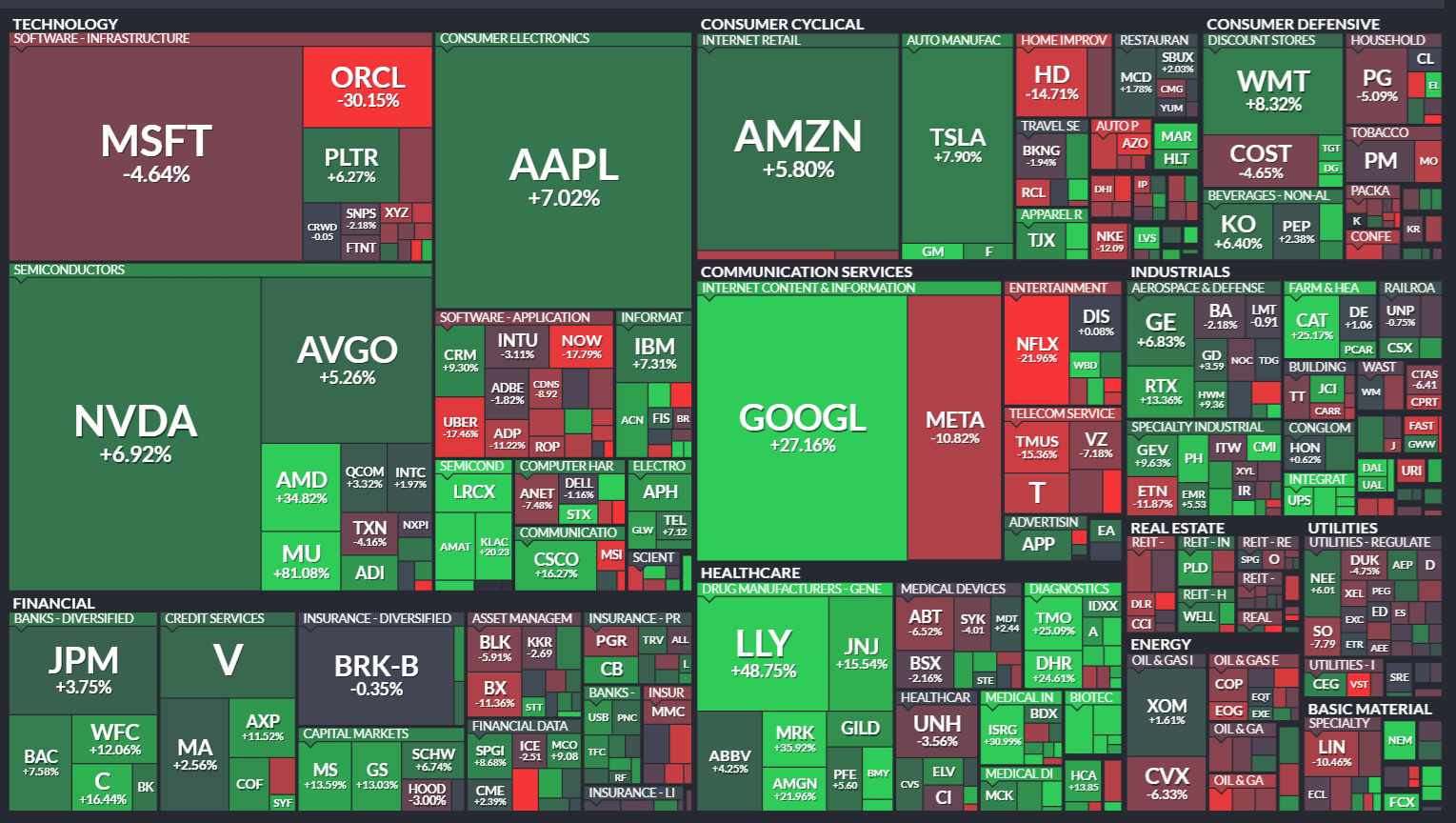

Here’s how the markets did this year:::

$DJI ( ▲ 0.47% ) Year 14%

$SPY ( ▲ 0.72% ) Year 17%

$QQQ ( ▲ 0.89% ) Year 18%

$IWM ( ▲ 0.0% ) Year 14%

$AAPL ( ▲ 1.54% ) Year only +13% but forming a beautiful base ❤️

$AMZN ( ▲ 2.56% ) Year flat as a pancake. Some say that Bezos and his ex wife keep selling off shares and that has caused price to stall

$CAT ( ▼ 0.1% ) Year +65% Go Cat GOOOO!!!!

$HD ( ▲ 0.97% ) Year -11% ( tariffs )

$GE ( ▲ 2.53% ) Year +88% 😁 It’s the first stock we bought here and have played it ever since

$GOOG ( ▲ 3.74% ) Year +63% has room to run

$JPM ( ▲ 0.89% ) Year +40% this one is just getting started. You guys know that I’m a big fan of JPM not just for the stock but the favorable Options pricing too…..I went long again before the holiday break and am currently up 38% with my long Call Options already

Plus I added to it on Friday ( trade down below )

$META ( ▲ 1.69% ) Year +10% yepp, Market Makers are still p—-d at “The Zuck”

$TSLA ( ▲ 0.03% ) Year +16% ( lots of new competition came out )

$WMT ( ▼ 1.51% ) Year +24% we like the chart here, a turnaround could be in the making

Those are the names that we’re playing the most right now

Old friends like $COST ( ▼ 0.26% ) and $SFM ( ▼ 0.55% ) are around when applicable

Right now I have a Strangle going on with SFM that is producing here

Lets look at that one soon

~~~~~~~~~~~~~~2026~~~~~~~~~~~~~~~~~

It’s upon us my trader friends

Ready to make some bigger money?

The markets are offering signs that could be the case coming

If Cardiologists had their way we all would walk 60 minutes straight each day

For those over 75, weaker, or just unable to then 30 minutes straight

Straight is the operative adjective here

What science tells us is that by walking for longer times, ( 60 minutes for most ) and not 10 six minute walks, or 6 ten minute walks, we invoke a stronger response not only from our cardiovascular system, but from our musculoskeletal system as well.. And the more you do it outside in the sunshine and natural air the better

Here at theoptionscoach.net

We don’t chase stocks

We don’t go long if a stock is red

We buy at the MID price or better

We set STOPS and HONOR them

Friday was a slow day as expected

What I did do was take the FEB 20, 2026 325 Calls on JPM

Its a smaller position as its still the holidays and volume is low

Unless JPM drops or pops in spectacular fashion on Monday those are still valid to consider

1st:

Right now we’re seeing signs for entries into longer term plays

For a while I’ve been saying how I would L💓VE to play Calendar Spreads, they’re easy peasy / low stress / rent collecting / longer term / income generators

GE and JPM both appear to be readying themselves for that, GOOG may be also

2nd:

It also appears to be the time to do some “Set it and forget it” in the way of “LEAPS”

Long Term Equity Anticipation Securities

LEAPS are made for longer term investors that capitalize through the power of Options to not only maximize greater gains, but do so with far less capital than basic stock investors

3rd:

Trends, we need trends going north for both of those strategies

Calendar Spreads work best with slow “Steady Eddies,”

We want steady consistent growth, not “moon shots”

The reason is we will be selling Premium each week to pay for our longer dated Calls

If we sell a $100.00 Call we don’t want price going to $105.00 overnight, we then lose the Premium we sold. They’re called “calendars” for a reason

Yes we would still make money on the long side of the trade, but do you want to make $100.00 or $1,000.00?

We’ll talk more about that when we start them, trust me its way less complicated than it sounds

Calendar Spreads were created to generate income whether its on a weekly basis or a monthly. When the stock isn’t going north we still “collect rent” from the Premium giving us downside protection and income both

LEAPS simply want growth over a longer time frame

Moon Shots welcome 😁

4th:

We have one more week of holiday non action ( most likely but not a guarantee ) to go before the markets will truly show us what they want. We’re not chasing, we don’t chase. We’ve been diligent in allowing the market to come to us then determine which strategy to use at that time

5th

I’m still in the process of creating one big “Chart Pack” that I spoke about a few weeks ago

That may be next Sunday…

I’m sure we’ll speak before then but if we don’t, Happy New Year to all…..

The Options Coach

One Week

One Month

Three Month

2025

DISCLAIMER: All content provided in this newsletter, blog, webinar, video, chart, communication is for Educational and Entertainment purposes only. Nothing included or mentioned is meant to be construed or used as trading / investment / financial advice. Trading / investing carries risk of loss, losses can and do occur. NO recording aloud...Know your risk and risk of loss before taking on any financial endeavors. Past performance is NOT a |

guarantee of future success. I am NOT a licensed or registered financial advisor or tax accountant. Prior to making any trading / investing / financial decisions you should always consult with your licensed and registered financial advisor and tax accountant. There are no recommendations or solicitations to buy, sell or hold any stock, future, options or bonds, cryptocurrency or any other financial entity in this newsletter. Nor are there any recommendations on any type or way or method to trade / invest. You do not have permission to redistribute this newsletter without my written permission fir |