- The Options Coach

- Posts

- Weekly Recap OCT 5, 2025

Weekly Recap OCT 5, 2025

Weekly....

Hey traders how are you?

Did you get out and walk in nature this weekend?

$DJI ( ▲ 0.47% ) +1.10% Weekly

$SPY ( ▲ 0.72% ) +1.12% Weekly

$QQQ ( ▲ 0.89% ) +1.21% Weekly

$IWM ( ▲ 0.0% ) +1.86% Weekly

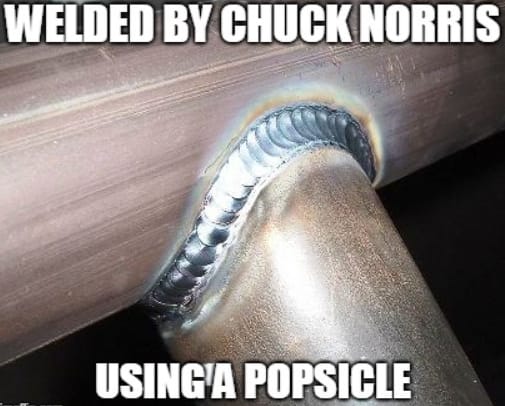

Many of you know that welding is a passion of mine

Welders are a breed of their own. In my younger years I worked construction, residential and commercial. Was in 2 different unions, became a foreman and even had my own gig for a while. In “the trades” everyone knows not to mess with the welders, it’s not that they’re any tougher ( well maybe a little bit 🙃 ) but that they just ~ truly ~ honestly ~ do ~ not ~ care ~ what ~ anyone ~ thinks ~about ~ them. I mean that. If a welder messes up, they can die. Think about it, welding is melting 2 separate metals together while using acetylene gas. Sparks are flying everywhere….

Gas can go B💥💥M!!!!!!!!!!

Like I said, welders are a breed of their own

Successful traders have that trait, when I say successful I mean the ones that if you lock them in a room with a dime, they’ll come out with a dollar. If you want success in the markets, part of any successful strategy is to cut out losing trades

I do that in my life, people that make excuses, I don’t call them. You can’t trust them, you can’t... Excuses are just another word for lies, and I don’t have time for liars

This week the markets hit fresh ATH’s twice, but on Friday they stalled out

And many were making excuses as to “why”

We’re reactionary traders / investors here, we don’t care “why” days like Friday occur, only how can we profit from it. That’s exactly what we did with our $TSLA ( ▲ 0.03% ) trade

Friday I said this:::::::: As always with Strangles we need movement, either direction we don’t care … With TSLA’s pullback Friday we could see a big recovery, or more downslide

A trader can drop which ever side of the trade that’s losing if they feel that a true direction has been established ::::::::::::::::::

We got that movement on Friday with TSLA’s continued downside action

For traders that entered that trade they should be watching it, yes that trade is ITM but not a home run. We were making money on it Friday while many were not

TSLA is a strong stock, don’t count it out, a reversal would take a strong price move north to put it ITM on the long side of our Straddle> The flip side is if TSLA continues south on Monday a trader would want to maintain the current position

The entire reason we took the Strangle this week was to capture the volatility, and it served us well

For the week it closed down 2.4% …… Earnings are on OCT 22, 2025

$GE ( ▲ 2.53% ) teaser teaser… That 300 / 310 Bull Call Spread initiated on Thursday then mentioned again on Friday is still in play… We might be adjusting it tomorrow ( I’ll report that in the morning ) it needs to get back above 300 for us to love it. It did close up on the week by 0.81% Wooooo!!!!!! lol…….

$META ( ▲ 1.69% ) On Thursday I said this::::::::::::

~~$META ( ▼ 2.27% ) I’m not convinced, not yet, one up day doesn’t make a recovery~~ It closed down this week by 4.36%

Today I still hold that belief, it’s in a downtrend for now

$NVDA ( ▲ 1.02% ) Do you remember 80’s rock band “The Clash”? Their big hit called “Should I stay or should I go” On the daily chart NVDA could be setting up for a pullback, on the weekly chart it’s saying “Lets Go”!! It closed up with an impressive 5.3% on the weekly…. Right now I could say “If it does this, then do that” or vise versa, but to be honest we’re going to wait until morning to see the price action on it before mentioning any new entries. If it Gaps up or down either way, by lets say 2.5%, we would want to go off of those numbers, not where it’s at now

$JPM ( ▲ 0.89% ) is another long time friend of ours that has treated us well

Right now a pullback could be starting, it closed down 1.9% on the week

$RDDT ( ▲ 2.77% ) I’m almost embarrassed to even mention this one but I need too

This week it fell by almost 14%… Ouch…….

But on Friday it bounced by 3.13%

Sooo, what does that mean? Great question my astute stock students 😃

It means that on a daily chart RDDT could be setting up for what is known in technical analysis as a “J-Hook Pattern” Those are bullish, they happen very fast, and very swift

If this isn’t a set up for a J-Hook then Friday could of been a Dead Cat Bounce and our price target to the short side would be the 185 area

$CAT ( ▼ 0.1% ) Wowwwww , that one has been a friend of ours for a long time too, why or how we haven’t visited with it in a while is beyond me. It closed up 7% on the week

I’ll be searching for entries here

Tell your friends about theoptionscoach.net

See you in the morning

The Options Coach

One Week

One Month

Three Month

😂😁 🤣 🙂 🙃 😁 😂 🤣 😃 😅 😆 🙃 😁 😂 🤣 😆 🙃 🤣

DISCLAIMER: All content provided in this newsletter, blog, webinar, video, chart, communication is for Educational and Entertainment purposes only. Nothing included or mentioned is meant to be construed or used as trading / investment / financial advice. Trading / investing carries risk of loss, losses can and do occur. NO recording aloud...Know your risk and risk of loss before taking on any financial endeavors. Past performance is NOT a |

guarantee of future success. I am NOT a licensed or registered financial advisor or tax accountant. Prior to making any trading / investing / financial decisions you should always consult with your licensed and registered financial advisor and tax accountant. There are no recommendations or solicitations to buy, sell or hold any stock, future, options or bonds, cryptocurrency or any other financial entity in this newsletter. Nor are there any recommendations on any type or way or method to trade / invest. You do not have permission to redistribute this newsletter without my written permission fir |